CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on July 31, 2024

|

Simpson Thacher & Bartlett llp gaikokuho jimu bengoshi jimusho

|

|

ark hills sengokuyama mori tower 41st floor 9-10, roppongi 1-chome minato-ku, tokyo 106-0032, japan

|

|

telephone: +81-3-5562-6200 facsimile: +81-3-5562-6202 |

July 31, 2024

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Crypto Assets

100 F Street, NE

Washington, DC 20549

Attention:

Lulu Cheng

J. Nolan McWilliams

| Re: | Coincheck Group B.V. |

Amendment No. 1 to

Registration Statement on Form F-4

Filed May 7, 2024

File No. 333-279165

Ladies and Gentlemen:

On behalf of Coincheck Group B.V. (the “CCG”), we are concurrently transmitting herewith Amendment No. 1 (“Amendment No. 1”) to the Registration Statement on Form F-4 (the “Registration Statement”) filed by the Company to the U.S. Securities and Exchange Commission (the “Commission”) on May 7, 2024. The Registration Statement includes disclosure regarding the operations of, and consolidated financial statements for, Coincheck, Inc. (the “Company”). In this letter, we respond to the comments of the staff of the Commission (the “Staff”) contained in the Staff’s letter dated July 8, 2024 (the “Letter”). The numbered paragraphs below correspond to the numbered comments in the Letter, and the Staff’s comments are presented in bold italics.

In addition to addressing the comments raised by the Staff in the Letter, the Company has revised the Registration Statement to update certain other disclosures, including to update the Company’s disclosure to include its financial results for the fiscal year ended March 31, 2024.

| BEIJING | Brussels | HONG KONG | Houston | LONDON | Los Angeles | New York | Palo Alto | SÃo Paulo | Washington, D.C. |

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 2

Registration Statement on Form F-4 filed May 7, 2024

General

| 1. | Please note that we continue to consider your accounting policies and disclosure detailed in your prior responses and may have further comment. |

In response to the Staff’s comment, the Company acknowledges that there may be further comments in connection with the Company’s accounting policies and the disclosure provided in prior responses.

| 2. | You state that Goldman Sachs & Co. LLC notified Thunder Bridge that it terminated its engagement as financial advisor in the transaction. Please provide us with any correspondence between Goldman Sachs and Thunder Bridge relating to Goldman Sachs’s resignation. Additionally, tell us whether Goldman Sachs was involved in the preparation of any disclosure that is included in the registration statement, or material underlying disclosure in the registration statement, including but not limited to the disclosure regarding the summary of the financial analyses prepared by Coincheck’s management and reviewed by the board of directors of Thunder Bridge or the projected financial information of Coincheck. If Goldman Sachs was involved in preparing this disclosure, include a risk factor describing their role in connection with the preparation of the registration statement and the valuation of Coincheck and that they disclaim any liability in connection with that disclosure included in the registration statement. If applicable, please also disclose the rationale for continuing to rely on information disclaimed by the professional organization associated with or responsible for that information. Please also caution investors that they should not place any reliance on the fact that Goldman Sachs has been previously involved with the transaction. |

In response to the Staff’s comment, the Company has provided under separate cover the termination letter and resignation letter, each from Goldman Sachs to Thunder Bridge. Goldman Sachs was not responsible for the preparation of any disclosure that is included in the Registration Statement, or any analysis underlying such disclosure. Together with all other members of the transaction working group, Goldman Sachs received drafts of the Registration Statement prepared by the parties and provided limited comments in the ordinary course. In further response to the Staff’s comment, the Company has revised the disclosure on pages 86 and 87 of Amendment No. 1.

| 3. | Please provide us with the engagement letter between Thunder Bridge and Goldman Sachs. Please disclose any ongoing obligations of Thunder Bridge under the engagement letter that will survive the termination of the engagement, such as indemnification provisions, rights of first refusal, and lockups, and discuss the impacts of those obligations on Thunder Bridge. |

In response to the Staff’s comment, the Company has provided under separate cover the engagement letter between Goldman Sachs and Thunder Bridge. In further response to the Staff’s comment, the Company has revised the disclosure on pages 153 and 154 of Amendment No. 1.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 3

| 4. | Please disclose whether Goldman Sachs assisted in the preparation or review of any materials reviewed by the Thunder Bridge board of directors or management as part of their services to Thunder Bridge and whether Goldman Sachs has withdrawn its association with those materials and notified Thunder Bridge of such disassociation. For context, include that there are similar circumstances in which a financial institution is named and that the firm’s resignation indicates it is not willing to have the liability associated with such work in this transaction. |

In response to the Staff’s comment, the Company has revised the disclosure on pages 153 and 154 of Amendment No. 1.

| 5. | Please discuss any potential impact on the transaction related to the resignation of Goldman Sachs. If Goldman Sachs would have played a role in the closing, identify the party who will be filling that role. Also disclose any fees paid or due to Goldman Sachs in connection with its role as a financial advisor to Thunder Bridge and whether Goldman Sachs performed substantially all the work to earn its fees. If any of these fees will be forfeited by the firm’s resignation, please disclose this information. |

In response to the Staff’s comment, the Company has revised the disclosure on pages 153 and 154 of Amendment No. 1

Frequently Used Terms, page 3

| 6. | We note your response to prior comment 31 and the added disclosure on page 4 related to Customers (or users). Your disclosure seems to imply that for the purposes of your audited consolidated financial statements and unaudited interim consolidated financial statements, the term “customer” may include all parties that utilize the services provided on crypto asset platforms regardless of whether they meet the definition of a customer under IFRS 15. Please revise your disclosures to clarify that for purposes of Coincheck’s audited consolidated financial statements and unaudited interim consolidated financial statements included elsewhere in this proxy statement/prospectus, “customers or users” refer to parties that meet the definition of a customer under IFRS 15. |

In response to the Staff’s comment, the Company has revised the disclosure on page 4 of Amendment No. 1 to clarify the definition of “customers or users” in the Company’s audited financial statements.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 4

Summary of the Proxy Statement/Prospectus

The Proposals to be Submitted at the Stockholders Meeting

Proposal No. 1 The Business Combination Proposal

Business Combination Agreement, page 12

| 7. | Please enhance your disclosures to clarify how the 125 million of PubCo Ordinary Shares reconciles to related disclosures on pages 21 and 31. |

In response to the Staff’s comment, the Company has revised the disclosure on page 13 of Amendment No. 1.

Comparative Per Share Information, page 21

| 8. | Please enhance to disclose the respective parties’ underlying holdings for combined pro forma common stock issued and outstanding, including how such amounts reconcile to related disclosures on page 31. Also clarify why Thunder Bridge’s historical shares issued and outstanding of 6,561,250 excludes 3,517,087 of redeemable stock which footnote 1 discloses are included. |

In response to the Staff’s comment, the Company has revised the disclosure on pages 22 and 32 of Amendment No. 1 to reflect only Class A shares, consistent with the presentation of the table. The Company notes that while the table on page 22 no longer references the Class B shares, these shares reconcile as follows, wherein the total shares from page 32 less earnout shares as referenced in footnote 4 to the table equal the 129,708,075 shares disclosed under the Maximum Redemption Scenario within the unaudited pro forma condensed combined financial information:

| From page 32 of Amendment No. 1 | Less Earnouts | |||||||||||

| Monex | 131,352,978 | (25,000,000 | ) | 106,352,978 | ||||||||

| Other Coincheck | 16,234,638 | — | 16,234,638 | |||||||||

| Thunder Bridge Public | 2,924,486 | — | 2,924,486 | |||||||||

| Thunder Bridge Sponsor | 6,561,251 | (2,365,278 | ) | 4,195,973 | ||||||||

| 129,708,075 | ||||||||||||

Unaudited Pro Forma Condensed Combined Financial Information, page 133

| 9. | Please revise your description of the business combination to include a discussion of each discrete transaction you will undertake to effect the reorganization and Business Combination. In your revised disclosure, consider adding a table to reflect the number of shares exchanged for each step of the business combination. In addition, please clarify for us how each discrete transaction has been reflected in your pro forma financial statements. |

In response to the Staff’s comment, the Company has revised the disclosure beginning on page 135 of Amendment No. 1 to discuss the discrete steps to effect the reorganization and Business Combination. The Company believes that the transaction has been appropriately reflected within the pro forma financial statements and respectfully advises the Staff that the primary impact to the pro forma financial statements relates to the issuance of ordinary shares of the Company outstanding immediately prior to the Share Exchange Effective Time which will be exchanged for PubCo Ordinary Shares, as well as the issuance of Earn-Out shares. Because the impact to the pro forma financial statements is limited to the issuance of ordinary shares of the Company outstanding immediately prior to the Share Exchange Effective Time and the issuance of Earn-Out shares, the Company did not include a table to the pro forma financial statements.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 5

| 10. | We note the maximum redemption scenario presented in your pro forma financial statements results in a negative cash balance. We further note your disclosure in footnote K to your pro forma financial statements that the Business Combination Agreement includes a minimum cash condition. Please be advised the purpose of pro forma financial statements is to provide investors with sufficient information about the impact of probable transactions to allow them to make informed decisions. In this regard, it is not clear how you determined it is appropriate to present negative cash balances in the pro forma financial statements since it does not reflect outcomes that can occur. Please revise the pro forma financial statements to comply with Article 11 of Regulation S-X or explain to us how and why you believe the current presentation is meaningful or appropriate. |

In response to the Staff’s comment, the Company has revised the pro forma financial statements to present accounts payable for any unpaid costs at the close of the Business Combination. Additionally, with regard to the minimum cash condition, the Company has revised disclosure in the footnote in Note L to its pro forma financial statements on page 144 of Amendment No. 1 to reflect the following: “The Business Combination Agreement includes a minimum cash condition. This is a term that is defined contractually within the Business Combination Agreement and may be waived by the parties to the Business Combination Agreement. As the minimum cash condition may be waived and the transaction may close with cash below that level, the minimum has been ignored for the purposes of determining the maximum redemptions that may occur.”

Proposals

to be Considered by Thunder Bridge’s Stockholders

Proposal No. 1 — The Business Combination Proposal

Dilution, page 160

| 11. | Please tell us and enhance your disclosures to clarify how you calculated the Sponsor’s investment per Founder Share of $0.004. |

In response to the Staff’s comment, the Company has revised the disclosure on pages 88 and 163 of Amendment No. 1 to explain that the Sponsor invested $6,505,055 in the equity of the Company, inclusive of the Founder Shares and the private placement units. Of this amount, the Sponsor paid $25,000 for an aggregate of 6,468,750 Founder Shares. In connection with the partial exercise of the over-allotment option and the expiration of the over-allotment option following the Company’s initial public offering, the Sponsor forfeited 555,554 Founder Shares for no consideration. Accordingly, the Sponsor paid approximately $0.004 per share for the 5,913,196 Founder Shares the Sponsor holds today.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 6

Information

About Coincheck

Partnership with Circle, page 214

| 12. | Please discuss the material aspects of your partnership with Circle, including a summary of the terms of any agreements you have entered into with Circle and the status of any application for Electronic Payment Instrument Services license. Please add a risk factor describing the risks of offering USDC on your exchange. |

On February 27, 2024, the Company announced plans to enter into a partnership with Circle Internet Financial, LLC (“Circle”) to expand access to USDC in the Japanese market. Currently, the Company is in discussions with Circle regarding the specific details of the partnership, and nothing has been agreed upon and no contract has yet been signed.

Because the discussions are still in an early stage, and the significant fluidity of the situation renders the information regarding the plans and the potential risks of offering USDC on the Company’s exchange not yet material, the Company has revised the disclosure to remove references to the potential partnership with Circle. To the extent a more firm partnership with Circle develops, the Company will then include a description of the partnership in future disclosures and describe the risks of offering USDC as part of the Company’s products and services in a manner that it deems appropriate based on the relevant circumstances at such time.

Coincheck Management’s Discussion and Analysis of Financial Condition and Results of Operations

Recent Developments and Outlook, page 228

| 13. | We note your disclosures on page 230 of Exchange and Marketplace trading volumes by month. Please address the following with respect to your disclosure: |

| ● | Enhance your disclosures to explain why Exchange trading volumes are meaningful and/or relevant and how they correlate to the level of commission revenue recognized; and |

| ● | Tell us how you considered disaggregating Exchange trading volume between matched sellers and purchasers and transactions in which you are a party to the transaction (e.g. purchases and sales with cover counterparties). |

In response to the Staff’s comment, the Company has revised the disclosure on page 234 of Amendment No. 1 to clarify why Exchange trading volumes do not directly correlate with commission received and why, in spite of the foregoing, growth in Exchange trading volume is meaningful to the Company, as well as to clarify that the monthly Exchange trading volume disclosure does not include purchases and sales with cover counterparties.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 7

| 14. | We note your disclosure of operating data (Exchange trading volume, Marketplace trading volume etc.) for the calendar years ended 2022 and 2023. Given your financial results are presented on a March 31 fiscal year end, please tell us how you determined your table provides sufficient information for investors to understand trends in your operating results. In that regard, we note the data presented in your table only provides information for the final three months of the fiscal year ended March 31, 2022. |

In response to the Staff’s comment, the Company has revised the disclosure beginning on page 234 of Amendment No. 1 to include monthly data from April 2021, the beginning of the Company’s fiscal year ended March 31, 2022 through June 2024, and clarifying the fiscal periods that correlate to these months.

Key Business Metrics and Trends

IEO-related Revenue, page 235

| 15. | We note your response to prior comment 7 and the related revisions to your disclosure. Please tell us, and consider disclosing, the amount of IEO revenue you recorded for the most recent interim or annual period presented in your financial statements for fiscal year 2024. |

In response to the Staff’s comment, the Company has revised the disclosure on page 241 of Amendment No. 1 to include the amount of IEO revenue recorded in the year ended March 31, 2024. The Company also revised the disclosure to exclude mention of any transaction revenue resulting from the IEOs. Such transaction revenue is a result of proprietary selling activities by the Company of the tokens received as the IEO commissions. The tokens received are recorded at fair value and included in our balance sheet as an asset. As the Company sells the token through proprietary selling activities, it then records the proceeds from the sale as transaction revenue for which the cost of sales would be the fair value of the asset previously recorded on the Company’s balance sheet. Because the timing of when the Company sells the tokens is at its discretion and is not necessarily in the same fiscal period as the relevant IEO, the Company excluded the information relating to such proprietary sales from being a part of the IEO revenue.

Components of Results of Operations

Transaction revenue, page 240

| 16. | It appears that your transaction revenue is comprised of revenue from multiple sources (e.g. revenue derived from the Marketplace platform, revenue from cover counterparty transactions on the Exchange platform, certain revenue generated from IEO transactions etc.). Please tell us what consideration you have given to providing a table in your MD&A disaggregating transaction revenue by source. |

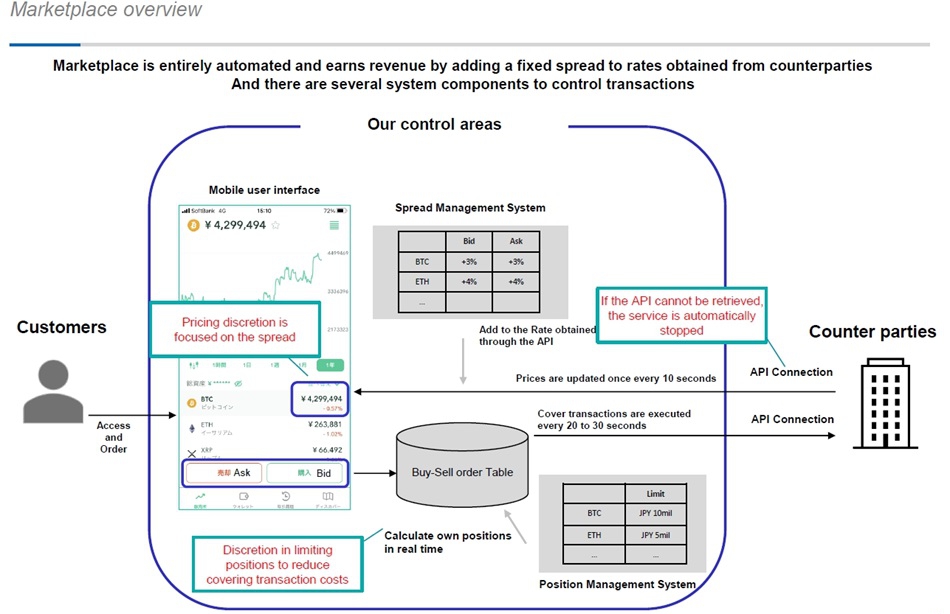

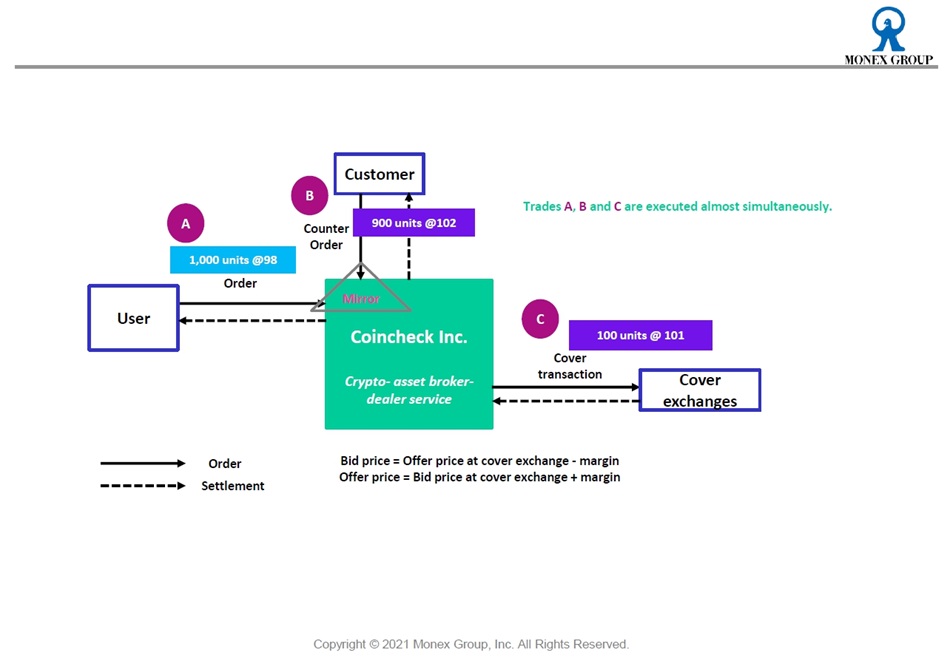

In response to the Staff’s comment, the Company notes that Transaction revenue consists of Marketplace platform revenue and transactions at the Exchange platform where the Company uses its own crypto assets to transact with customers and cover counterparties. As discussed in Note 6 and the Company’s response to comment 15 above, revenues from commissions earned in the Company’s IEO business are included in Commissions received. Upon review of our Transaction revenue, we disaggregated cover counterparty transactions from Marketplace platform transactions. In light of the foregoing and in response to the Staff’s comment, the Company has added a table on page 244 of Amendment No. 1 to illustrate the breakdown of transaction revenue into transactions with customers and transactions with cover counterparties. Please also refer to Annex A of this letter which depicts the flow of transactions as outlined in the Company’s Preclearance Letter submitted to the Staff dated December 14, 2023.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 8

Recent Quarterly Results, page 242

| 17. | We note your response to prior comment 11 and the related revisions to your disclosure. Given the presence of recent quarterly results disclosure related to Coincheck in this section, please tell us the relevance of disclosure related to Monex Group to Coincheck investors. |

The Monex Group disclosure is related to its Crypto Asset segment, for which the Company is the only entity included in the segment, and as such, the public disclosure by Monex Group with respect to this segment constitutes recent and relevant information on the Company’s financial performance available for disclosure.

With respect to the Company’s financial information for the three months ended June 30, 2024, the Company respectfully submits that the Company is still in the process of preparing its financial information for the three months ended June 30, 2024, although Monex Group has already announced financial results for such quarter, including the Crypto Asset segment information. Due to the differences in accounting treatment as disclosed in the prior filing, the Company does not believe that disclosing only the Crypto Asset segment information of Monex Group, without disclosing the Company’s corollary financial information alongside it, would present meaningful and relevant information for readers, and the prior filing included information for both the Monex Group Crypto Asset segment and the Company for this reason. Because the Company’s financial information is not yet ready, the Company has decided to remove the disclosure on recent quarterly results from Amendment No. 1. However, the Company undertakes to include such disclosure (with the clarification regarding the context of the disclosure as set forth in this response) for future filings if the Company’s financial information for the most recent quarter is available at the relevant time. In addition, the Company respectfully submits that it has disclosed monthly operating data through June 2024 beginning on page 234 of Amendment No. 1, which provides readers with information they can utilize to assess the Company’s performance in the most recent quarter in the absence of the quarterly financial results.

Coincheck, Inc. Financial Statements

Notes to the Consolidated Financial Statements

Note 1. Reporting Entity, page F-51

| 18. | Please clarify for us how you accounted for the divestiture of Coincheck Technologies, Inc. to Monex Group, Inc. in January 2023. In your response, please provide us with summarized financial information of Coincheck Technologies, Inc. (including summarized information about the prior subsidiary’s financial position and profit or loss) for each period presented in your interim and audited financial statements. Cite any relevant accounting literature in your response. |

The Company acknowledges the Staff’s request and has provided the financial information for each period presented below. The Company sold all of the shares of Coincheck Technologies, Inc., a wholly-owned subsidiary of the Company prior to the sale, which was accounted for in accordance with IFRS 10.25, resulting in the deconsolidation of Coincheck Technologies, Inc. Within the financial statements for the fiscal year ended March 31, 2023, management considered the overall materiality of the disposal transaction in the context of IFRS 5 and concluded that the disposal was not material and that further disclosure or presentation with respect to held for sale or discontinued operations was not necessary. Management also decided not to disclose detailed information regarding this disposal transaction, as the impact of the disposal transaction on the consolidated statements of profit or loss and other comprehensive income was a loss on sale of ¥5 million for the year ended March 31, 2023, which it considered immaterial. Thus, the Company removed “Note 32. Disposal of a subsidiary.”

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 9

For the Staff’s reference, Coincheck Technologies, Inc.’s summarized financial position and profit or loss for each period presented are presented below.

| As of March 31, |

As of September 30, | |||||||||||

| 2023 | 2024 | 2023 | ||||||||||

| (in millions of yen) | ||||||||||||

| Assets: | ¥ | 81 | ¥ | — | ¥ | — | ||||||

| Liabilities: | 76 | — | — | |||||||||

| For the years ended March 31, |

For the six months ended September 30, |

|||||||||||||||||||

|

2022 (as restated) |

2023 | 2024 | 2023 | 2024 | ||||||||||||||||

| (in millions of yen) | ||||||||||||||||||||

| Profit (loss) before income taxes: | ¥ | 110 | ¥ | 119 | ¥ | — | ¥ | — | ¥ | — | ||||||||||

(b) Commission received, page F-70

| 19. | In your revenue recognition policy for commission received, you include the statement “sales of crypto assets by the Group to the customer on the Group’s marketplace platform result in the Group recognizing transaction revenue in accordance with the revenue recognition policy described at (a) Transaction revenue.” Please expand your disclosure to explain why this statement is a necessary part of your commission received accounting policy. For example, to the extent a significant portion of commissions are paid in crypto assets, please revise your disclosure to state that fact. |

In consideration of the Staff’s comment, the Company notes that commissions are primarily paid in cash rather than crypto assets. Non-cash consideration received was limited to ¥0 million, ¥82.0 million, and ¥0 million in 2022, 2023, and 2024, respectively, which represents less than 0.1% of revenues. Upon review of the disclosure, the Company has revised Note 3 Material accounting policies (10) Revenue (b) Commission received on page F-66 of Amendment No. 1 to exclude such paragraph regarding transaction revenue as it was not relevant to the commission received.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 10

Note. 4 Significant accounting policies

(13) Revenue and expenses

(a) Transaction revenue, page F-70

| 20. | Please enhance your disclosure to include a more detailed discussion of how you define customer for purposes of applying IFRS 15. In your revised disclosure, please consider including a discussion of the venue on which each class of customer transacts (e.g. marketplace or exchange platform). |

In acknowledgment of the Staff’s comment, the Company has revised Note 3 Material accounting policies (10) Revenue (a) Transaction revenue on page F-65 of Amendment No. 1 to reflect the following: “Transaction revenue is mainly derived from sales transactions with the Company’s customers. The Company’s customers include parties who hold accounts and utilize the services provided on the Company’s crypto asset platforms, which includes customers on the marketplace platform as well as cover counterparties in sale cover transactions on the Company’s and third-party exchanges. However, users that purchase crypto assets from other users on the Company’s exchange platform but are not charged a commission do not meet the definition of a customer under IFRS 15. When the Company trades with customers on its marketplace platform, the Company adds a bid-ask spread to the prices of the Company’s cover transactions.”

| 21. | Please expand your disclosure to clarify when you measure the fair value of noncash consideration received as transaction revenue. |

In acknowledgment of the Staff’s comment, the Company has updated Note 3 Material accounting policies (10) Revenue (a) Transaction revenue on page F-65 of Amendment No. 1 to reflect the following: “When the Group receives cryptocurrencies as non-cash consideration, the Company measures the received cryptocurrencies at fair value at the time of delivery.” The Company also notes that this policy is consistent with IFRS 15:BC254B.

Note 21. Crypto asset borrowings, page F-91

| 22. | We note your disclosure that interest expense related to crypto asset borrowings are included in “Cash flows from operating activities” in the statements of cash flows. Please tell us and enhance your disclosures to clarify how related interest expense is paid and settled with the borrower and if paid in cash. Please also provide us with a copy of the Coincheck lending terms and conditions and related consumption loan agreement. |

As described in Article 13, Paragraphs 1 and 2 of the Crypto Assets Loan Agreement Terms and Conditions, interest payable in relation to the borrowing of crypto assets is calculated for the period by multiplying the loan volume by the rate of the usage fee and is paid in the same crypto assets borrowed from the customer (non-cash). As described in Article 1, Paragraph 2 of the same agreement, with regard to the method of payment of interest expense, the quantity of crypto assets borrowed plus interest is returned to the customer’s account balance at the expiration of the contract.

For the cash flows from operating activities in the statement of cash flows, the Company utilizes the indirect method. Interest expense for the borrowing of crypto assets is included in “Selling, general and administrative expenses” in the statement of profit or loss and other comprehensive income, and is paid from crypto assets held in the statement of financial position. Therefore, in the statement of cash flows, interest expense is included as an adjustment to reconcile Profit (loss) to net “Cash flows from operating activities” because it is indirectly represented in profit (loss) before income tax and represents an (increase) decrease in crypto assets held.

In response to the Staff’s comment, the Company has revised the disclosure in Note 20 on page F-87 of Amendment No. 1 to further clarify that interest paid reflects a reconciling item rather than cash outflow from operating activities. The interest expenses related to crypto asset borrowings, paid in the same cryptocurrency, for the years ended March 31, 2022, March 31, 2023 and March 31, 2024 were 124 million yen, 49 million yen, and 35 million yen, respectively, which were included in “Transaction related costs” of “Selling, general and administrative expenses” in the statements of profit or loss and other comprehensive income. The interest expenses related to crypto asset borrowings for the years ended March 31, 2022, March 31, 2023 and March 31, 2024 were included as an adjustment to reconcile profit (loss) to “Cash flows from operating activities” in the statements of cash flows. The Company’s loan terms and related loan agreements are attached in Annex B.

United States Securities and Exchange Commission

Division of Corporation Finance

July 31, 2024

Page 11

Should the Staff have additional questions or comments regarding the foregoing, please do not hesitate to contact the undersigned at +1 (212) 455-2163 (work) or mbrod@stblaw.com (email), or, in his absence, Taki Saito at +81-3-5562-6214 (work) or tsaito@stblaw.com or Xochitl Romo at +81-3-5562-6221 (work) or xochitl.romo@stblaw.com (email).

| Sincerely, | |

| /s/ Mark Brod | |

| Mark Brod | |

| Simpson Thacher & Bartlett LLP |

| Enclosures | ||

| cc: | Nelson Mullins Riley & Scarborough LLP | |

| Jon Talcott | ||

| Peter Strand | ||

Annex A

Marketplace overview Our control areas Prices are updated once every 10 seconds API Connection Access and Order Spread Management System User Add to the Rate obtained through the API Calculate own positions in real time Counter parties 0 Ask Bid +3% +3% BTC +4% +4% ETH … Buy - Sell order Table Mobile user interface Limit JPY 10mil BTC JPY 5mil ETH … … Cover transactions are executed every 20 to 30 seconds API Connection Bid Ask Customers Position Management System Marketplace is entirely automated and earns revenue by adding a fixed spread to rates obtained from counterparties And there are several system components to control transactions If the API cannot be retrieved, the service is automatically stopped Discretion in limiting positions to reduce covering transaction costs Pricing discretion is focused on the spread

A-1

Copyright © 2021 Monex Group, Inc. All Rights Reserved. Coincheck Inc. Crypto - asset broker - dealer service User Customer Cover exchanges Mirror Order Counter Order Cover transaction 1,000 units @98 100 units @ 101 Bid price = Offer price at cover exchange - margin Offer price = Bid price at cover exchange + margin 900 units @102 A B C Trades A , B and C are executed almost simultaneously. Order Settlement

A-2

Annex B

This English translation is prepared for submission to the Staff and for reference purposes only. It is not a legally definitive translation of the original Japanese texts. In the event a difference or inconsistency arises regarding the meaning herein, the original Japanese version shall prevail as the official version.

Coincheck Cryptoasset Lending Transaction Manual

When engaging in the cryptoasset lending services (the “Transaction”) offered by Coincheck Inc. (“Coincheck”), please carefully read and fully understand the contents of this Manual.

In commencing or continuing a Transaction, please carefully read the contents of this Manual, the Cryptoasset Lending Terms and Conditions (the “Terms and Conditions”), the Coincheck Cryptoasset Lending Terms of Service (the “Terms of Service”), the Coincheck Terms of Service, and the Coincheck Cryptoasset Transaction Manual.

The custody of cryptoassets other than those lent by Users to Coincheck under a loan agreement amounts to “management of cryptoassets on behalf of another person” as provided for in Article 2, Paragraph 15, Item 4 of the Payment Services Act (“Payment Services Act”). This Manual also constitutes a document to be delivered in accordance with the provisions of Articles 21 and 22 of the Cabinet Office Order on Cryptoasset Exchange Service Providers.

B-1

Transaction Risks and Other Important Matters

| I. | Cryptoassets are not Japanese or foreign currency. |

| II. | The cryptoassets handled by Coincheck are “decentralized cryptoassets” that are traded and issued over the internet, and their value is not guaranteed by any particular state or party. |

| III. | Losses may be incurred in the Transaction due to fluctuations in the price of the cryptoasset being traded. |

| IV. | Cryptoassets may be used for payment in lieu only with the consent of the person receiving such payment. |

| V. | Cryptoassets may be lost in whole or in part due to cyber-attacks or other causes. |

| VI. | Changes in the external environment (including stricter laws and regulations on cryptoassets), deterioration in Coincheck’s financial condition, the bankruptcy of Coincheck outsourcing partners, etc. may result it in being impossible for Coincheck to continue its business. In the event of Coincheck’s bankruptcy, Coincheck may be unable to return assets, and Users may incur losses. |

| VII. | The custody of cryptoassets other than those lent by Users to Coincheck amounts to “management of cryptoassets on behalf of another person” as provided for in Article 2, Paragraph 15, Item 4 of the Payment Services Act. Accordingly such cryptoassets are subject to segregated management, however cryptoassets lent to Coincheck are not subject to segregated management by cryptoasset exchange service providers under the Payment Services Act, and such cryptoassets do not have preferential payment rights. |

Cryptoassets subject to segregated management will be kept separate from Coincheck’s cryptoassets and managed in a cold wallet that is not connected to the internet or any other external network, in a state in which each User’s holdings can be immediately identified digitally. For details, please refer to “4. Secure Management of User Assets”.

For other risks, please refer to “5. Transaction Risks”.

B-2

1. Overview of Coincheck as Cryptoasset Exchange Service Provider

| (1) | Trade Name: | Coincheck, Inc. |

| (2) | Address: | 3-6 Maruyamacho, Shibuya-ku, Tokyo |

| (3) | Date of Establishment: | August 28, 2012 |

| (4) | Capital: | 112,000,000 yen |

| (5) | Name of Representative: | Satoshi Hasuo, Representative Director |

| (6) | Business Type: | Cryptoasset Exchange Business (Registration No.: Kanto Regional Financial Bureau 00014) |

| (7) | History: |

| August 2012 | Reju Press Co., Ltd. established |

| August 2014 | Cryptoasset trading service Coincheck launched |

| September 2016 | Coincheck Denki launched |

| March 2017 | Trade name changed to Coincheck, Inc. |

| June 2017 | Launch of Coincheck Cryptocurrency Lending Service (currently Coincheck Cryptoasset Lending Service) |

| April 2018 | Become subsidiary of Monex Group, Inc. |

| January 2019 | Became member of Japan Virtual and Cryptocurrency Exchange Association (currently Japan Virtual and Crypto Assets Exchange Association) |

| January 2019 | Completed registration as virtual currency exchange business (currently cryptoasset exchange business) |

| September 2019 | Launch of Coincheck Surveys |

| October 2019 | Launch of Coincheck Gas |

| November 2019 | Launch of Coincheck Tsumitate |

| March 2021 | Launch of Coincheck NFT (beta) |

| July 2021 | Launch of Coincheck IEO |

| (8) | Major Shareholder: | Monex Group, Inc. |

| (9) | Association Memberships: | Japan Virtual and Crypto Assets Exchange Association, Japan Cryptoasset Business Association, Japan Blockchain Association |

| (10) | Disclosures: | Financial statements and disclosures regarding the cryptoasset exchange business are disclosed on the following website. |

https://corporate.coincheck.com/disclosure

B-3

2. Overview of Cryptoassets handled by Coincheck

For an overview of the cryptoassets handled by Coincheck, please refer to the “Overview of Cryptoassets Handled” section on Coincheck’s website.

3. Transaction Details

(1) About the Transaction

The Transaction is a service which allows Users to lend cryptoassets to Coincheck under a loan agreement. To use this service, Users must first open a cryptoasset lending account (“Account”). In addition, the opening of the Account requires the opening of a User account as described in the Coincheck Cryptoasset Transaction Manual. Applications can be made from the transaction page of the User account. The process from applying to lend cryptoassets to the completion of lending are as follows.

1. Transfer of Cryptoassets to Account

Please transfer the cryptoassets for which a loan application is to be made from the user account to the Account.

2. Application for Cryptoasset Lending

From the Account trading page, an application is made by specifying the amount of cryptoassets to be lent (an amount equal or greater to the minimum amount separately designated by Coincheck) and the loan period. It is possible to setup automatic reapplication for lending after expiration of the loan period at the same time. *Automatic reapplication may take some time to be completed.

3. Coincheck Approval

Coincheck approves applications after taking into consideration the total borrowing limit set by Coincheck for each cryptoasset. The total borrowing limit is not disclosed as it varies depending on the situation, however please refer to Coincheck’s website for timely notifications regarding currencies which are below the total borrowing limit.

Upon approval by Coincheck, an Individual Agreement will be established under the Terms and Conditions, and lending will commence. Please note that with respect to cryptoassets which are in the process of, or prior to application, as no Individual Agreement has been established, the payment of the Usage Fee or the amount equivalent to consumption tax will not be payable by Coincheck.

Please note that, in principle, early termination during the contract period of an Individual Agreement is not permitted.

4. Return of Cryptoassets and Payment of Usage Fees, etc.

After the expiration of the contract period, in accordance with the Terms and Conditions, cryptoassets in the same or equivalent amount as that lent shall be returned to the Account and the Usage Fee and an amount equivalent to consumption tax will be paid within the period stipulated in the Terms and Conditions.

In the case that at the time of application, automatic lending reapplication after expiration of the loan was selected, a loan application will be submitted once more. *Automatic reapplication may take some time to be completed.

B-4

(2) Transaction Channel

The Transaction may be made via the internet using a personal computer or by other means. Please note that applications via customer support, email, or telephone cannot be accepted.

In addition, applications cannot be made via smart phone applications.

(3) Application Acceptance Hours

Applications are accepted 24 hours a day, 365 days a year. There are no regular system maintenance hours, however temporary maintenance may be carried out.

(4) Cryptoassets Handled

In principle, the cryptoassets handled by Coincheck are the same as those handled by the cryptoasset exchanges and cryptoasset sales offices as described Coincheck Cryptoasset Transaction Manual.

(5) Transfer of Cryptoassets

Cryptoassets can be transferred between the Account and User accounts from each account’s transaction page. Cryptoassets cannot be sent from or received in the Account.

(6) Confirmation and Reporting of Transactions, etc.

The status of applications, etc. can be confirmed on the transaction page. In addition, a report (CSV file format) describing transaction details will be prepared and provided once per month.

(7) Hard Forks

For Coincheck’s policy on hard forks and newly created cryptoassets as a result of hard forks, and how this is communicated to users, please refer to “Policy on Planned Hard Forks and New Coins” on Coincheck’s website. When granting cryptoassets newly created by a hard fork or delivering money in an amount equivalent to such cryptoasset, Coincheck may charge a fee for the costs incurred in such granting or delivery.

4. Secure Management of User Assets

(1) Segregated Management

The custody of cryptoassets other than those lent by Users to Coincheck amounts to “management of cryptoassets on behalf of another person” as provided for in Article 2, Paragraph 15, Item 4 of the Payment Services Act. Accordingly such cryptoassets are subject to segregated management, and the method of management is as follows.

Such cryptoassets are managed in a cold wallet that is not connected to the internet or any other external network, in a state in which each User’s holdings can be immediately identified digitally.

User cryptoasset balances on the books are reconciled with cryptoasset balances in User wallets for each cryptoasset each business day. In the case that as a result of reconciliation, it is confirmed that the cryptoasset balance in User wallets is less than the cryptoasset balance on the books, such shortfall will be resolved within 5 business days from the day which immediately follows.

Cryptoassets that are lent to Coincheck are not subject to segregated management by cryptoasset exchange service providers under the Payment Services Act, and do not have preferential payment rights.

B-5

(2) Other Secure Management Methods

Coincheck creates cold wallets for all cryptoassets it handles and manages User cryptoassets entrusted to Coincheck by Users in such wallets.

(3) Facilities and Personnel Required for Operations Related to Secure Management and Methods of Operation

Coincheck has established the necessary facilities for the operations described in (1) and (2) above, as well as sufficient personnel for the operation of such facilities. Coincheck has established internal rules for the operation of such matters.

(4) Policy for Loss of Assets

In the case that cryptoassets entrusted by Users to Coincheck are lost due to leaks, loss or damage of the private keys necessary for transfer of cryptoassets or other information, or for other reasons, if, having taken into account various circumstances, Coincheck has determined that it would be difficult to transfer the same type of cryptoassets, Coincheck shall instead transfer other cryptoassets to the User in an amount equivalent to the relevant cryptoasset calculated at a price determined by Coincheck, or refund such amount in cash to the User. Refunds shall be made promptly after Coincheck has determined the method of such refunds.

For details, please refer to the “Performance of Obligations Policy”.

5. Transaction Risks

(1) Price Fluctuation Risk

Cryptoassets are not legal tender and are not backed by legal tender. The price of cryptoassets fluctuates on a daily basis. The price of cryptoassets may be affected by trends in prices, currencies, securities markets, and other markets, natural disasters, wars, political upheavals, strikes, strengthening of regulations, the proliferation of other similar cryptoassets, and other unforeseen or extraordinary events in the future. As a result, the value of User cryptoasset holdings and trades may fluctuate or decline rapidly. In addition, please be aware that the value of cryptoassets may drop to zero.

(2) Risk of Changes in Fees, etc.

Coincheck may change the rules concerning the Transaction in the future.

(3) System Risk

Transactions conducted by Users are made using an electronic trading system.

There may be circumstances in which the electronic trading system becomes unavailable temporarily or for a certain period of time due to various reasons, including failure of Coincheck or the User’s communication or system equipment, communication failures, or disasters. In addition, transactions may be suspended in the event of an electronic trading system failure.

There is a risk that system failures may occur due to changes in the external environment, etc. which may disrupt User transactions. A system failure refers to the case in which Coincheck determines that there is an obvious malfunction in the systems used to provide Coincheck’s services (excluding line failures or issues with User computers, etc.).

B-6

(4) Bankruptcy Risk

Changes in the external environment (including stricter laws and regulations on crypto assets), deterioration in Coincheck’s financial condition, and the bankruptcy of Coincheck outsourcing partners, etc. which provide systems and other necessary services to Coincheck may result it in being impossible for Coincheck to continue its business.

If it becomes impossible for Coincheck to continue its business, it will be subject to proceedings under applicable laws and regulations, such as the Bankruptcy Law, Civil Rehabilitation Law, Corporate Reorganization Law, and Company Law, including actions concerning User assets.

In the event of Coincheck’s bankruptcy, Coincheck may be unable to return assets, and Users may incur losses.

In addition, cryptoassets may be lost or their value may decrease due to the bankruptcy of the issuer or administrator of the cryptoassets.

(5) Risk of Restriction on Early Termination and Early Sales

In principle, Users are not permitted to terminate or sell cryptoassets during the loan period. Accordingly, during the loan period, loaned cryptoassets cannot be sold or transferred.

(6) Risk of Early Return of Cryptoassets

Coincheck may return cryptoassets to Users at any time upon payment of a Usage Fee proportionate to the contract period. Accordingly, it is possible that the User may not receive the originally anticipated Usage Fee.

(7) Risk of Exclusion of Segregated Management

The custody of cryptoassets other than those lent by Users to Coincheck amounts to “management of cryptoassets on behalf of another person” as provided for in Article 2, Paragraph 15, Item 4 of the Payment Services Act. Accordingly such cryptoassets are subject to segregated management, however cryptoassets lent to Coincheck are not subject to segregated management by cryptoasset exchange service providers under the Payment Services Act, and such cryptoassets do not have preferential payment rights.

(8) Risk of Changes in Laws and Regulations

In the future, changes in laws and regulations, taxation, or policies may result in the prohibition or strengthening of restrictions on cryptoasset transactions, restrictions on holding or trading cryptoassets, or less favorable treatment than at present. In such cases, Users may incur unexpected losses.

(9) Risk of Attacks by Other Parties

Cryptoassets may be lost in whole or in part due to cyber-attacks.

For cryptoassets other than those lent by Users to Coincheck, Coincheck creates cold wallets and manages cryptoassets in such wallets. However, in the unlikely event of intrusion by a third party at a Coincheck location, there is a possibility that all or a part of the cryptoassets managed by Coincheck may be lost. In addition, there is a possibility of partial or complete suspension of services due to cyber-attacks.

(10) Risk of Damages Due to Circumstances Beyond Coincheck Control

Users may incur losses due to natural disasters, public line communication failures, delays in the recording process in the value transfer recording mechanism for cryptoassets, or other circumstances beyond the control of Coincheck. Coincheck will not be liable for any such losses.

The above is a brief description of typical risks associated with the Transaction, and is not intended to be an exhaustive list of all risks involved.

B-7

6. Complaints Desk

Coincheck receives User complaints through the following contact point.

Customer Experience Department

3-6 Maruyamacho, Shibuya-ku, Tokyo

Inquiry form: https://coincheck.com/ja/info/help_contact

TEL 03-4405-3842

Reception hours: The inquiry form is available 24 hours a day, 365 days a year, and responses to inquiries will be handled in the order in which they are received.

Telephone inquiries will be handled Monday through Friday from 9:00 through 18:00 (excluding holidays stipulated in the National Holidays Law and New Year holidays (December 31 through January 3))

*For inquiries regarding account opening, deposits, withdrawals, and transactions, please contact Coincheck using the inquiry form.

7. Complaints Response

Coincheck will respond to complaints or inquiries regarding its cryptoasset exchange business (“Business”) in good faith as follows, in accordance with its internal regulations.

(1) Complaints may be made by Users or by their heirs or representatives.

(2) Users may file complaints concerning the Business through the Coincheck complaints desk. Even in cases where it is not clear whether the User complaint relates to Coincheck’s Business or not, Coincheck will respond in good faith.

(3) The Customer Experience Department of Coincheck will, depending on the content of the complaint, report complaints from Users to the President and CEO, and handle such complaints appropriately.

(4) The President and CEO of Coincheck shall, as necessary, direct the Corporate Administration Department to investigate and analyze the situation, and take measures to prevent recurrence.

(5) The Corporate Administration Department of Coincheck shall periodically review the status of responses to User complaints.

(6) The Customer Experience Department of Coincheck shall also refer Users to customer dispute resolution support organizations as necessary.

B-8

8. Finance ADR

For the resolution of disputes related to Coincheck’s cryptoasset exchange business, mediation procedures (Finance ADR) are available at the Arbitration (Dispute Resolution) Center established and operated by the Tokyo Bar Association, First Tokyo Bar Association, and Second Tokyo Bar Association, respectively.

1-1-3 Kasumigaseki, Chiyoda-ku, Tokyo

Tokyo Bar Association Dispute Resolution Center TEL: 03-3581-0031

First Tokyo Bar Association Arbitration Center TEL: 03-3595-8588

Second Tokyo Bar Association Arbitration Center TEL: 03-3581-2249

9. Certified Fund Settlement Business Operator Association Complaints Desk

The Japan Virtual and Crypto Assets Exchange Association, a certified fund settlement business operator association for cryptoasset exchange business, also accepts complaints.

Japan Virtual and Crypto Assets Exchange Association

Complaints form: https://jvcea.or.jp/contact/form-contact/

TEL: 03-3222-1061

Hours: Monday to Friday 9:30 to 17:00 (excluding public holidays (including substitute holidays) and the New Year holidays (December 29 to January 3))

June 20, 2023

B-9

This English translation is prepared for submission to the Staff and for reference purposes only. It is not a legally definitive translation of the original Japanese texts. In the event a difference or inconsistency arises regarding the meaning herein, the original Japanese version shall prevail as the official version.

Cryptoasset Lending Terms and Conditions

Chapter 1 General Provisions

Article 1. Contents of Agreement

| (1) | The User and Coincheck Inc. (“Coincheck”) may enter into a loan agreement with respect to the Loaned Property as provided for in Article 2, Item 2 hereof (hereinafter, these terms and conditions are referred to as this “Agreement”, and individually concluded loan agreements are referred to as an “Individual Agreement”) in accordance with the provisions set forth below. |

| (2) | This Agreement stipulates the terms and conditions of the Individual Agreement applicable to the User and Coincheck, including the payment of the Usage Fee after the return of Substitute Property to the User as provided for in Article 2 Item 3 hereof after the expiration of the Contract Term. |

Article 2. Definitions

The definitions of terms used in this Agreement shall be as follows.

| (1) | “Cryptoassets” shall mean cryptographic assets as separately designated by Coincheck. |

| (2) | “Loaned Property” shall mean Cryptoassets lent by the User to Coincheck. |

| (3) | “Substitute Property” shall mean Cryptoassets of the same or equivalent amount as the Loaned Property. |

| (4) | “Usage Fee” shall mean the fee paid by Coincheck to the User after expiration of an Individual Agreement Contract Term as consideration for the lending of the Loaned Property. |

| (5) | “Contract Term” shall mean to the loan period for an Individual Agreement, which is the period for which the Usage Fee payable by Coincheck to the User shall be calculated. |

| (6) | “Usage Fee Rate” shall mean the rate to be used in the calculation of the Usage Fee for the Loaned Property lent to Coincheck, which shall be determined separately. |

Article 3. Lending Unit

The unit of Loaned Property to be lent to Coincheck shall be as determined separately.

Article 4. Return Unit

The unit of Substitute Property to be returned by Coincheck to the User shall be entirely the same as that of the lending unit.

Article 5. Contract Term

The Contract Term shall be as separately determined.

B-10

Chapter 2 Offerings and Agreements, etc.

Article 6. Application for Individual Agreements

In order to apply for an Individual Agreement, it is necessary to open a “Cryptoasset Lending Service” account (“Account”). The procedures for applying for an Individual Account can then be completed from the menu by logging into the Account.

Article 7. Establishment of Individual Agreements and Contract Period

| (1) | Following the completion of the User’s application for an Individual Agreement and Coincheck’s review and approval, an Individual Agreement shall be established upon the completion of delivery of the Loaned Property from the User to Coincheck. |

| (2) | The Contract Term shall be calculated from the date of establishment of the Individual Agreement as provided for in the preceding paragraph. |

Article 8. Automatic Renewal

| (1) | Users that prefer that the Individual Agreement be automatically renewed should request this at the time of application for the Individual Agreement. |

| (2) | If a User has made the request provided for in the preceding paragraph and does not request that the Individual Agreement not be renewed by the date specified by Coincheck, the Individual Agreement shall be automatically renewed for a further equivalent Contract Period, and the same shall apply thereafter. |

Article 9. Early Termination

| (1) | The User may not terminate the Individual Agreement other than in the event of the death of the User, when a decision has been made to commence bankruptcy proceedings, when other unavoidable circumstances arise, or in cases which are approved by Coincheck. |

| (2) | In the event of termination, the User shall pay Coincheck a separately determined fee. |

| (3) | Usage Fees shall not be paid in the case of Loaned Property terminations. |

| (4) | Termination shall be effective upon confirmation by Coincheck of the User’s application for termination and receipt of the fee as described in Paragraph 2. |

| (5) | Coincheck shall return the Substitute Property to the User’s Account within 6 business days from the day following the effective date of termination. |

Article 10. Early Sale

The User may not sell the Loaned Property during the Individual Agreement Contract Term.

Article 11. Contract Termination

| (1) | In the event that the User falls under any of the following items, Coincheck may immediately terminate this Agreement and the Individual Agreement. |

| (1) | A false declaration was made at the time of application |

| (2) | Upon breach of this Agreement |

B-11

| (3) | Upon breach of relevant laws and regulations |

| (4) | In other cases, upon it being determined by Coincheck that it would be inappropriate to continue the Agreement with the User |

| (2) | In the event that the Loaned Property Cryptoassets falls under or is likely to fall under any of the following items, Coincheck may immediately terminate the Individual Agreement. |

| (1) | Upon Coincheck terminating its handling of such Cryptoasset |

| (2) | Upon the handling of such Cryptoasset being prohibited by regulatory authorities, etc. |

| (3) | Upon Coincheck determining it is unavoidable to do so |

| (3) | In the event that the Company terminates the Individual Agreement pursuant to provisions of the preceding two paragraphs, it shall be deemed that the User applied for early termination on the date of termination, and Coincheck shall follow the procedures provided for in Article 9 hereof. |

Article 12. Voluntary Return of Substitute Property by Coincheck

Notwithstanding the provisions of the preceding Article, Coincheck may return the Substitute Property at any time upon payment of a Usage Fee proportionate to the Contract Period. In such a case, Coincheck shall follow the procedures provided for in Article 9, Paragraph 5 hereof.

Chapter 3 Usage Fee and Return of Substitute Property

Article 13. Usage Fee and Consumption Tax Equivalent

| (1) | The Usage Fee is calculated by multiplying the loan amount by the Usage Fee Rate for the period, and payment shall be made in the form of the Cryptoasset that was lent to Coincheck by the User. |

| (2) | The amount equivalent to the consumption tax on the Usage Fee shall be paid together with the Usage Fee in the preceding paragraph, in the form of the Cryptoasset that was lent to Coincheck by the User. |

Article 14. Method and Date of Payment of Usage Fee

The Usage Fee and the amount equivalent to the consumption tax on the Usage Fee shall be paid to the User’s Account within 6 business days of the day following the expiration of the Contract Period.

Article 15. Return of Substitute Property and Date of Return

Coincheck shall return the Substitute Property to the User’s Account within 6 business days of the day following the expiration of the Contract Period.

Chapter 4 Notifications and Filings

Article 16. Confirmation of Conditions

The User may confirm the Usage Fee Rate and loan amount for the Loaned Property, and the Contract Period in the User’s Account.

Article 17. Amendment

Coincheck may amend this this Agreement due to changes in economic conditions, revision and repeal of laws and regulations, and for other reasons at the discretion of Coincheck. In the event of amendment of this Agreement, Coincheck shall notify the User of such amendment. The User shall not object to such notification.

B-12

Chapter 5 Other Matters

Article 18. Rights to Loaned Property

The Loaned Property is not User Property as provided for in Article 63-11 Paragraph 2 of the Payment Services Act, and is excluded from the obligation of segregation of accounts by Coincheck and from the assets subject to preferential payment as provided for in Article 63-19 Paragraph 2 Item 1 of said Act.

Article 19. Prohibition on Transfer and Pledging, etc.

The User shall not assign to a third party, or pledge or otherwise create a security interest in, the User’s position under this Agreement or an Individual Agreement, or its rights to Coincheck under this Agreement or an Individual Agreement.

Article 20. Cryptoasset Management Measures

In order to fulfil this Agreement and the Individual Agreements, Coincheck shall manage Cryptoassets for the Individual Agreements separately.

Article 21. Disclaimer

Coincheck shall not be liable for any damage caused by natural disaster, war, riot, civil unrest, revision or repeal of laws and regulations, and dispositions by public authorities, or other reasons not attributable to Coincheck.

Article 22. Jurisdiction

This Agreement shall be governed by the laws of Japan, and any and all disputes arising out of or relating to this Agreement shall be subject to the exclusive jurisdiction of the Tokyo Summary Court or the Tokyo District Court as the court of first instance, depending on the amount of the claim.

May 1, 2020

B-13

This English translation is prepared for submission to the Staff and for reference purposes only. It is not a legally definitive translation of the original Japanese texts. In the event a difference or inconsistency arises regarding the meaning herein, the original Japanese version shall prevail as the official version.

Cryptoasset Lending Terms of Service

These Terms of Service (“Terms of Service”) provide for the matters that Users must comply with when using the Cryptoasset Lending Service (“Service”) provided by Coincheck Inc. (“Coincheck”), and the rights and obligations between Coincheck and Users. Users that wish to use the Service are requested to read the entire Terms of Service prior to agreeing.

Article 1. Application

The purpose of these Terms of Service is to set forth the rights and obligations between Coincheck and Users that are registered as Registered Users and have a User Account (“User Account”) pursuant to the Coincheck Terms of Service as separately set forth by Coincheck, when using the Service, and shall apply to all relationships between the User and Coincheck related to use of the Service.

| (1) | The Service allows Users to lend Cryptoassets to Coincheck pursuant to a loan agreement. |

| (2) | For any matters not provided for in these Terms of Service, the Coincheck Cryptoasset Lending Terms and Conditions and Coincheck Terms of Service shall apply. |

| (3) | Users shall apply for the Service at their own discretion and responsibility, with a full understanding of these Terms of Service, the Coincheck Cryptoasset Lending Transaction Manual, the Cryptoasset Lending Terms and Conditions, the Coincheck Terms of Service, the Coincheck Cryptoasset Transaction Manual, guidelines, policies, notices and other individual regulations, etc. |

Article 2. Applicable Cryptoassets

The cryptoassets subject to the Service shall be those handled in spot trading at cryptoasset exchanges and cryptoasset sales offices pursuant to the Coincheck Terms of Service.

Article 3. Account Opening

| (1) | In order to use the Service, it is necessary to be registered as a Registered User and have opened a User Account pursuant to the Coincheck Terms of Service as separately set forth by Coincheck. |

| (2) | Users shall open an account for the Service (“Cryptoasset Lending Account”) in accordance with the procedures provided for by Coincheck. |

Article 4. Loan Agreement

The Cryptoasset Lending Terms and Conditions shall be applicable for loan agreements related to the Service.

Article 5. Transfers and Loan Applications

| (1) | In using the Service, Users shall transfer the cryptoassets they wish to lend (“Lendable Cryptoassets”) from the User Account to the Cryptoasset Lending Account. |

| (2) | Users shall make a loan application to Coincheck by specifying the type and amount of Lendable Cryptoassets to be lent (an amount equal or greater to the minimum amount separately designated by Coincheck) and the loan period in the Cryptoasset Lending Account. |

B-14

Article 6. Management of Cryptoassets in Cryptoasset Lending Accounts

| (1) | Coincheck shall manage the cryptoassets in Cryptoasset Lending Accounts (which refers to cryptoassets other than those currently loaned out, that are prior to or during the process of an application to be lent. “Standby Cryptoassets”) in accordance with the Payment Services Act (“Payment Services Act”), as it falls under a cryptoasset exchange service provider under Article 2, Paragraph 15, Item 4 of the Payment Services Act. |

| (2) | Coincheck shall manage Standby Cryptoassets separately from its own cryptoassets in accordance with Article 63-11 Paragraph 2 of the Payment Services Act. |

Article 7. Transaction History

Users shall be able to check the status of cryptoassets loaned and deposited through the Service from the transaction page of the User’s Cryptoasset Lending Account.

Article 8. Hard Forks

With respect to cryptoassets currently loaned out or Standby Cryptoassets, even in cases where cryptoassets are newly created as a result of hard forks, the User may not demand Coincheck grant or handle such newly created cryptoassets.

Article 9. Agreed Matters

The User hereby confirms, understands and agrees to the following matters regarding the Service.

| (1) | The Service is not a deposit or deposit-like product, nor is it covered by deposit insurance. |

| (2) | The User may incur losses due to a decline in the price of cryptoassets currently loaned out for the Service. |

| (3) | The management of cryptoassets currently loaned out for the Service does not fall under the acts provided for in Article 2, Paragraph 15, Item 4 of the Payment Services Act, and such cryptoassets shall not be subject to segregated management as provided for in Article 63-11 Paragraph 2 of the Payment Services Act. |

| (4) | Cryptoassets currently loaned out for the Service shall not be subject to preferential payment as provided for in Article 63-19 Paragraph 2 Item 1 of the Payment Services Act. |

Article 10. Prohibited Matters

Prohibited matters for the Service shall be as provided for in Article 12 of the Coincheck Terms of Service.

Article 11. Suspension of Service

Suspension of the Service shall be as provided for in Article 13 of the Coincheck Terms of Service.

Article 12. Termination

It is not possible to terminate the Cryptoasset Lending Account alone. Termination of the User Account will result in the Cryptoasset Lending Account also being terminated.

B-15

Article 13. Disclaimer

Disclaimers for the Service shall be as provided for in Article 17 of the Coincheck Terms of Service.

Article 14. Amendment to Terms of Service

| (1) | These Terms of Service may be amended in the event of changes to laws and regulations, instructions from regulatory authorities, changes in rules and regulations established by the Japan Virtual and Crypto Assets Exchange Association, or for other reasons deemed necessary by Coincheck. |

| (2) | In the event that Coincheck amends these Terms of Service, Coincheck shall notify the User of the change, the details thereof, and the effective date of the change. If the User uses the Service after such effective date, or does not follow the procedures for termination of the Service within the period specified by Coincheck, the User will be deemed to have agreed to such changes. |

June 20, 2023

Coincheck Inc.

B-16